Bombay Chartered Accountants’ Society jointly with Association of Chartered Accountants, Chennai, Chartered Accountants Association, Ahmedabad, CA Association of Jalandhar, The Chartered Accountants Study Circle, Chennai, Hyderabad Chartered Accountants Society, Karnataka State Chartered Accountants’ Association Lucknow Chartered Accountants’ Society Maharashtra Tax Practitioners Association, Pune Chartered Accountants Association , Surat

Taxation Committee

Chairman: CA Deepak Shah

Co-Chairman – CA Anil Sathe

Convenors: CA Hardik Mehta, CA Divya Jokhakar& CA Vishesh Sangoi

DIRECT TAX HOME REFRESHER COURSE – 5

Online Webinar (Zoom Platform) 22nd May, 2024 to 5th June 2024

Dear Members,

The Taxation Committee of the Bombay Chartered Accountants’ Society is pleased to present the 5th “Direct Taxes Home Refresher Course” jointly with, Association of Chartered Accountants, Chennai, Chartered Accountants Association, Ahmedabad, CA Association of Jalandhar, The Chartered Accountants Study Circle, Chennai, Hyderabad Chartered Accountants Society, Karnataka State Chartered Accountants’ Association and Lucknow Chartered Accountants’ Society, Maharashtra Tax Practitioners Association, Pune and Chartered Accountants Association , Surat.

Income Tax Practice has evolved rapidly over the years not only in India but globally. In last two decades, technology has played a pivotal role in transforming the same. In fact, with the onset of Artificial Intelligence (AI), the practice might be impacted structurally in coming years. The areas of practice both advisory and litigation has also changed. The issues arising from new legislations and amendments has taken the spotlight. There is a need to understand these complex issues and how to deal with them.

In order, to keep our members updated on various such amendments and relearn some of the evergreen topics in the income tax law, Society has once again come up with a unique and popular program, Direct Tax Home Refresher Course – 5. Like last year, we have designed this program jointly with nine other sister organizations so that a much larger number of tax practitioners across India can take benefit of the course.

The “Direct Tax Home Refresher Course – 5” will be conducted in the form of webinars, the details are given below.

|

Date & Time |

May 22, 24, 27, 29, 31 and June 3 ,5 – 3 pm to 7 pm

|

|

Venue |

Virtual Meeting |

Topics and speakers for Direct TAX Home Refresher Course (DTHRC):

|

Session |

Date |

Topics |

Speaker |

|

1 |

22.5.24 (Wednesday) |

Fundamentals of Income Tax – Scope and Charge of Income and Issues on the same |

CA YOGESH THAR |

|

2 |

22.5.24 (Wednesday) |

Taxation of Royalties and Fees for Technical Services including TDS under section 195 |

CA PRADIP MODI |

|

3 |

24.5.24 (Friday) |

Charitable Trusts Taxation – Understanding the recent uncharitable amendments in law and compliance including registration |

ADVOCATE T BANUSEKAR |

|

4 |

24.5.24 (Friday) |

Taxation issues with respect to various instruments in investment space, including overseas Investments. (Shares/ETF’s/ Treasury Bills/ Property etc) |

CA GAUTAM NAYAK |

|

5 |

27.5.24 (Monday) |

Deduction on payment basis 43B – A relook including payments to MSMEs including Form 3CD Reporting and landmark judgements on legacy issues of Section 43B |

CA B RAMAKRISHNAN |

|

6 |

27.5.24 (Monday) |

Judicial Analysis of recent judgments with special emphasis on case laws with respect to Reassessments

|

Adv. DHARAN GANDHI |

|

7 |

29.5.24 (Wednesday) 3 pm |

Private Trusts – Succession, FEMA and Income Tax implications |

CA NARESH AJWANI |

|

8 |

29.5.24 (Wednesday) |

Related Party Transactions – Understanding the implications under various sections of Income Tax vis-à-vis other acts and disclosure norms |

CA DR CHINNSAMY GANESAN |

|

9 |

31.5.24 (Friday) |

Cash Transactions under Section 69/69A and other issues |

CA KETAN VAJANI |

|

10 |

31.5.24 (Friday) |

Income Tax issues arising out of compulsory acquisition of Immovable Property |

CA PRADIP KAPASI |

|

11 |

03.6.24 (Monday) |

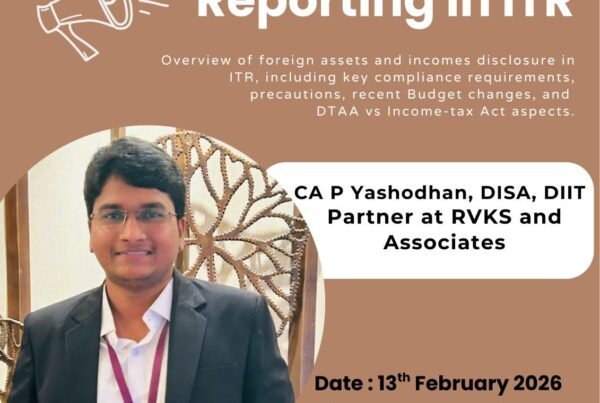

Reporting of Foreign Assets and repercussions of non-compliance vis-à-vis Black Money Act and PMLA |

CA KARTIK BADIANI |

|

12 |

03.6.24 Monday |

Taxation of proceeds of Life Insurance policies (incl ULIP) and intricacies of Sec 23(1)( c) |

CA JAGDISH PUNJABI |

|

13 |

05.6.24 (Wednesday) |

TDS/TCS obligations – A code in itself – Overview of recent additions and issues surrounding them |

CA BHAUMIK GODA |

|

14 |

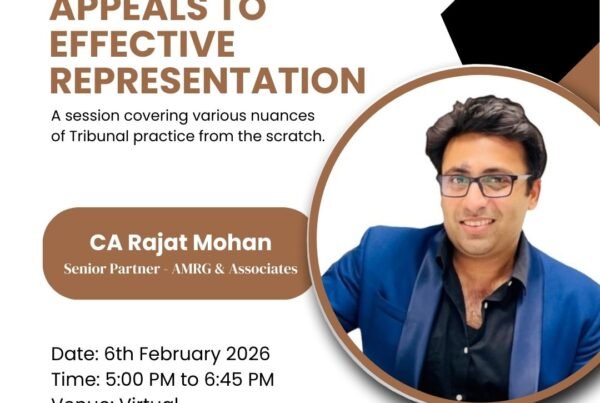

05.6.24 (Wednesday) |

Assessments, Reassessments and Appeals – Has Faceless regime made life easy? Common Mistakes or scenarios where assessees get notices for assessment |

CA MANTHAN KHOKHANI |

We look forward to active participation from our members across the country.